Published on | Last updated on

Want to know how to submit freelancer taxes in Germany? Learn how you can easily file taxes as a freelancer in Germany – all by yourself in simple English and without spending thousands of euros!

If you are a salaried employee then it’s relatively easy to file taxes using one of the many expat-friendly and affordable English online tax filing tools.

However, freelancer taxes in Germany are a whole different ballgame. Hiring a German tax consultant who can offer advice in English AND is familiar with freelancer taxes in Germany AND expat taxes is both rare and super expensive.

So what are the budget-friendly alternatives to file freelancer taxes in Germany?

In this post, I will describe how I use online tax filing tools to file my taxes as a freelancer in Germany – completely in English!

Disclaimer: This blog post may include affiliate links. These links do not cost you anything but I might earn a small commission if you decide to order something from one of my recommended partners. Thank you for your support to help keep this platform growing!

Online Tax Filing Software for Freelancers in Germany

You can use one of the following two online tax filing tools to file German freelancer taxes.

Software/ Features | ||

Trustpilot Rating (May '23) | 4.5/5 | 4.4/5 |

Language | EN/ DE | EN/ DE |

BOOKKEEPING | ||

Invoice Generation | Yes | Yes |

Expense Recording | Yes | Yes |

Payment Reminders | No | No |

TAX REPORTS (No ELSTER needed!) | ||

Profit & Loss Statement | Yes | Yes |

VAT Reporting | Yes | Yes |

Annual Tax Return | Yes | Yes |

Steuerberater On-Demand | Yes | Yes |

OTHER FEATURES | ||

Tax Reminders | Yes | Yes |

Bank Account Integration | Yes | Yes |

Bulk Data Import | Yes | NA |

Contract Flexibility | Monthly Cancellation | Monthly Cancellation |

Trial Period | Unlimited Free Account | Unlimited Free Account |

Starting Cost/ Month | € 20,00 | € 7,50 |

If you are looking for more solutions to file German freelancer taxes please feel free to check this detailed head-to-head comparison of GetSorted and Accountable.

Review of GetSorted

Let’s take a look at who can use GetSorted, and how you can prepare your freelancer taxes in Germany on your own with confidence and without paying an immoderate fee to a tax advisor.

1) What exactly is GetSorted?

GetSorted is an online tax tool created to serve the tax needs of freelancers living in Germany. It is developed by Zeitgold GmbH, a leading fintech firm that provides a digital bookkeeping platform for small businesses. So they know their stuff. 😉

GetSorted is available in simple German and English.

This tool single-handedly takes care of ALL stages of being a freelancer:

-

- it guides you through your registration process as a freelancer with your local Finanzamt

- it helps you keep track of your expenses and invoices

- it helps you file your Income-tax return (Steuererklärung), Annual VAT return (Umsatzsteuererklärung), Annual profit report (EÜR), Advance VAT declaration (Umsatzsteuer–Voranmeldung)

-

it also gives you access to on-demand help from your dedicated tax consultant at an additional charge

Click here to try out GetSorted for FREE

OR

Watch this quick video walkthrough of how it works

2) Who can use GetSorted?

GetSorted is a tool for freelancers, especially expat or non-german-speaking freelancers in Germany.

You can use GetSorted if:

- You want to become a freelancer in Germany

- You are a non-German-speaking freelancer who would prefer to use an English tax tool

- You are registered as Kleinunternehmer in Germany

- You charge VAT as a freelancer in Germany

- You have clients on Upwork or similar online freelance portals

- You have clients in or outside of Germany

- You are a sole trader selling goods

- You need occasional professional advice from tax consultants in Germany

If you are an expat freelancer with a special tax situation, you may still be able to use GetSorted to file your freelancer taxes in Germany. Read further if the following situations apply to you.

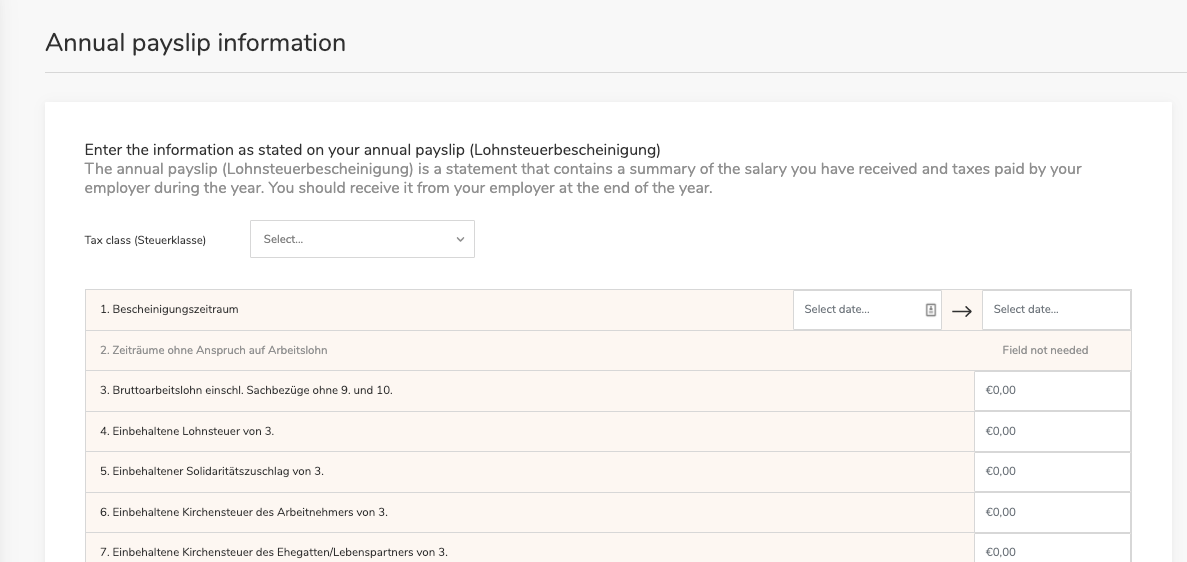

2.1) You are a salaried person besides being self-employed

It is common for salaried people to work as a freelancer on the side. This generally leads to a complicated tax situation. In this situation as well GetSorted can help you deal with your taxes as a freelancer in Germany with ease.

If you would like to consult a tax advisor, GetSorted can match you with a tax advisor in their network who can help you declare your salary when preparing your annual tax reports at an additional charge.

If you prefer to go the DIY route, you can easily add the details about any income from a salary within GetSorted’s UI without the help of the tax advisor.

2.2) You are a freelancer who is also married or has a family

Similarly, you can also use GetSorted if you are filing freelancer taxes in Germany as a married person.

You can get help from a tax firm in Sorted’s network to prepare the income tax return for you and your partner, which will make sure you get all the tax benefits that you are entitled to as a family.

2.3) You are an expat with an international income

Expats often have a complicated tax situation because of international income that can lead to double taxation. If you have income outside of Germany or investments in your home country, Sorted can still come in handy.

Sorted takes care of all your income generated in Germany. For managing taxes on any income earned outside of Germany, they pair you with a dedicated tax firm that can help you declare it at an additional charge.

PS: You may still need to separately declare your taxes in the country where you earned the income so please make sure to inform yourself about the tax laws in that country.

3) Who cannot use Sorted?

Unfortunately, Sorted does not support UG or GmbH companies. If you need an accounting or bookkeeping tool for your UG or GmbH firm, then read my detailed comparison of English accounting software for freelancers/ small businesses in Germany.

4) How can Sorted help you with freelancer taxes in Germany?

GetSorted is a simple yet powerful tool for filing taxes as a freelancer in Germany.

It can single-handedly support your freelance journey right from the beginning. If you are considering becoming a freelancer in Germany, you can sign up with Sorted to register yourself as a freelancer with German tax authorities. This service is free!

They offer a step-by-step guide in English and directly send the finished tax form to your responsible Finanzamt. It is a free service provided by Sorted.

If you already are a freelancer in Germany, then Sorted takes care of your basic bookkeeping and tax declarations.

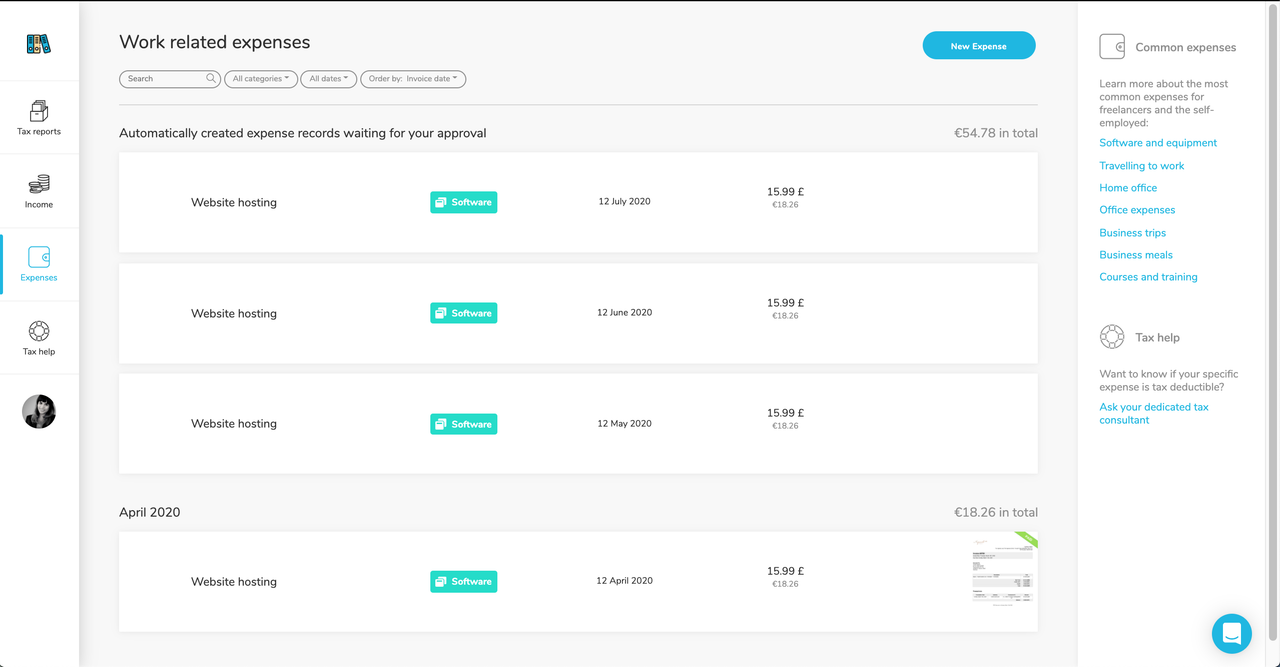

4.1) It helps you track your freelance expenses and income

When you log into Sorted, it will ask you to add expenses and income. The tool will guide you through adding your income and expenses. It will automatically prepare your tax reports based on your income and expenses, so you must ensure the accuracy of your data.

For adding expenses, Sorted UI lets you upload documents in various formats. There is also a dropdown list that easily categorises your business expenses.

If there are some recurring expenses you can simply select the frequency of the expenses. This feature is particularly handy because it automatically adds fixed expenses such as monthly internet or phone bills, legal insurance payments etc. You don’t need to upload an invoice and add a new expense manually each month.

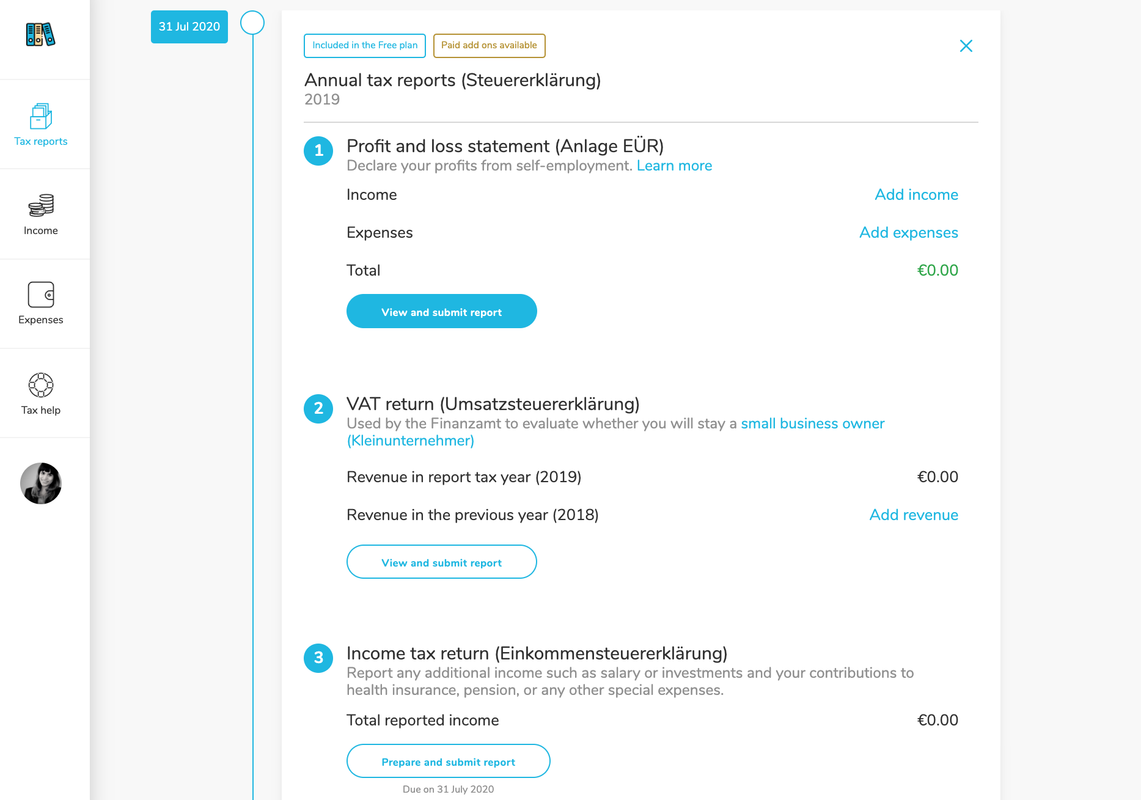

4.2) It automatically prepares your freelancer tax reports

Your tax reports are automatically prepared by Sorted based on the income and expenses you enter. You can submit your tax reports electronically to the Finanzamt through Sorted.

With Sorted you can prepare and file your:

- Advance VAT declaration (Umsatzsteuer-Voranmeldung)

- Income-tax return (Steuererklärung)

- Annual VAT return (Umsatzsteuererklärung)

- Annual profit report (EÜR)

4.3) It directly sends your tax reports to Finanzamt

Sorted submits your tax reports directly to the Finanzamt through the official online ELSTER interface. This software is connected with the Finanzamt through their official software provider, ELSTER. There is no need for you to create an ELSTER account or certificate for submission.

Once you submit your tax reports via Sorted, you will immediately receive a document confirming that the reports have been sent to the Finanzamt.

PS: It may take a few weeks or even months before the Finanzamt reviews your tax reports and sends you a tax assessment via post.

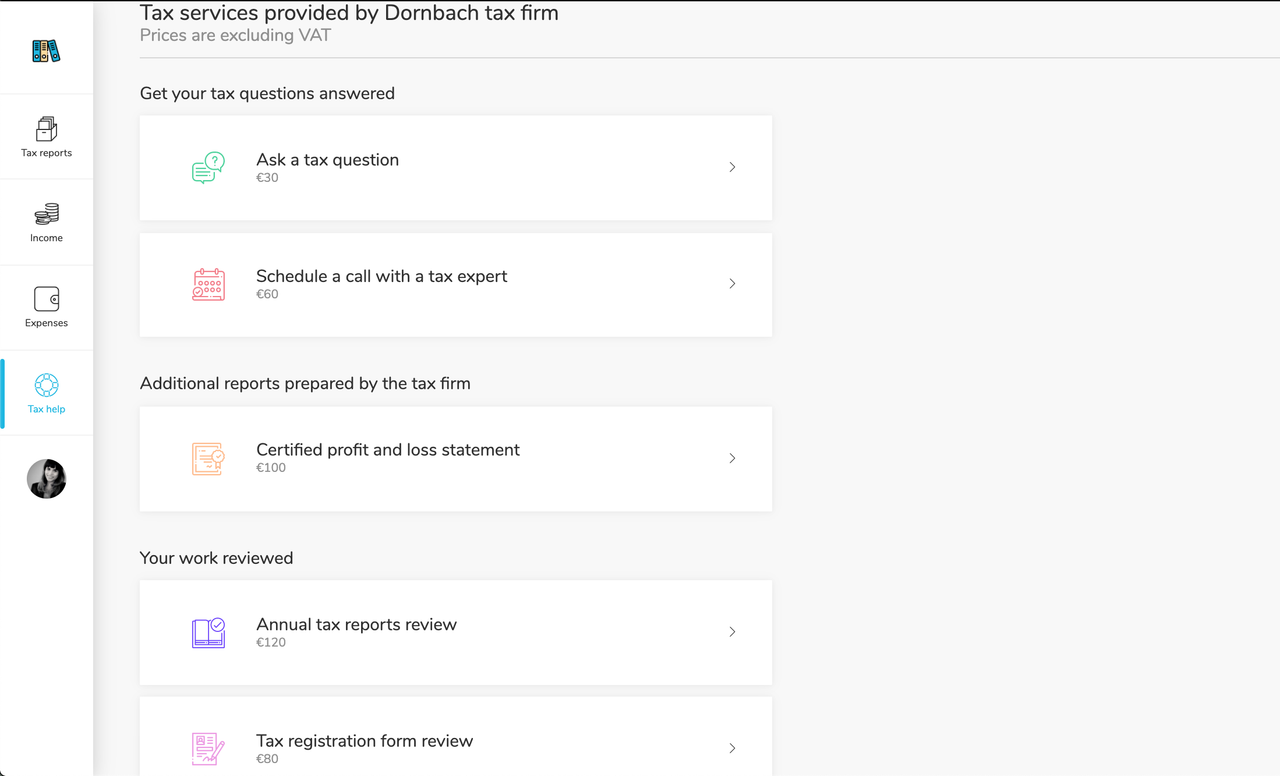

4.4) It gets you on-demand help from certified tax consultants in Germany

Even though Sorted is intended as a DIY tool for freelancers in Germany (albeit with several step-by-step guides and knowledge base), there are going to be moments when you may want to get professional tax advice.

For this, Sorted has a database of tax consultants in their network. When you sign up on Sorted, they automatically pair you with a dedicated tax firm. This tax firm supports you on demand and whenever you need additional guidance or reports for your specific case. Your tax consultant on Sorted can answer your complex tax questions in an easy-to-understand language, in English or German.

The consultation can be a simple ‘Ask a Question’, ‘Schedule a call’ or ‘Review Your Tax Report’ etc. Each consultation is charged at a fixed rate upfront so you always know how much you will pay to your tax advisor.

5) How much does Sorted cost

Currently Sorted offers THREE types of subscription plans for freelancers in Germany.

1) STARTER: With a Starter plan, you can register as a freelancer for free with Sorted. You can also take advantage of Sorted’s several bookkeeping features with this plan – connect your bank account, create invoices, and track income and expenses for free.

2) KLEINUNTERNEHMER: This subscription plan is for small businesses that earn under 22,000 EUR per year. With this plan, Kleinunternehmer can file its annual tax reports in Germany. The plan is priced at €98 per year including VAT.

3) PRO: Pro plan is suitable for those who have to file multiple tax reports in a year – such as monthly or quarterly advance VAT reports. Pro plan subscription costs €20 per month (€240 per year).

Check out the full Sorted features and pricing here.

If you are looking to manage freelancer taxes in Germany, it is totally worth trying out Sorted.

Until 2020, I had been paying over 2000 € per year to my tax consultant in Germany. This does not even include occasional phone calls or one-to-one consultations which used to cost me €100+ with 19% VAT per hour!

As you can see in my videos, I use Sorted for all my bookkeeping and filing freelancer taxes in Germany (for a very fair price!).

Going from over 2k to under 300€ per year for accounting and tax services are pretty significant annual savings.

Click here to try Sorted for FREE

Or watch this video walkthrough to see how Sorted can help you file taxes as a freelancer in Germany

Related Guides:

Learn about the tax reports for freelancers in Germany (and how to file them)

Learn about German freelancer tax IDs (and how to get them)

HY just wanted to ask you, i am starting my career as a sole proprietorship and working based on commision from internet service

i am considered gewebe not freelancer by german language

so as a gwewbe (sole trader) – is Sorted going to work for me? or is it just for pure freelancers.

Sure, sole traders can also use sorted. It’s also mentioned in their FAQs. https://en.getsorted.de/faq#is-sorted-for-me

Pingback: 7 Essential Tools & Insurances for Freelancers in Germany | Mademoiselle In DE